<p>In a landmark legislative victory, Republicans have delivered a sweeping bill to former President Donald Trump, just in time for a dramatic July 4 signing ceremony. Dubbed the “Big Beautiful Bill,” this nearly 900-page package touches nearly every aspect of American economic, immigration, healthcare, and environmental policy — and is set to reshape the nation’s priorities in the coming years.</p>

<p>But what exactly is in this massive piece of legislation, and how will it affect everyday Americans?</p>

<h2>A Narrow Victory in Congress</h2>

<p>The bill made its way through a deeply divided Congress. After passing the House in May by a razor-thin margin of 218-214, it was cleared in the Senate on Thursday — with Vice President JD Vance casting the deciding vote to break a tie. With Trump’s signature expected on Independence Day, the bill is set to become one of the most consequential legislative acts in recent memory.</p>

<h3>Key Takeaway: $4.5 Trillion in Tax Cuts</h3>

<p>At the heart of the bill lies $4.5 trillion in tax cuts—an extension of Trump’s 2017 Tax Cuts and Jobs Act. These include:</p>

<ul>

<li>A permanent extension of individual and estate tax reductions</li>

<li>An increase in the child tax credit to $2,500 per child, starting in 2025 (set to expire in 2028)</li>

<li>A new $6,000 tax deduction for older Americans earning less than $75,000 annually</li>

<li>Tax-free treatment of tips and overtime pay for workers earning under $150,000</li>

<li>A deduction for car loan interest, up to $2,500 annually, targeting middle-income families</li>

</ul>

<p><br />Additionally, the bill introduces “Trump Accounts” — $1,000 government deposits for every newborn between 2025 and 2028.</p>

<h2>What’s Changing for Medicaid and Healthcare?</h2>

<p>One of the most controversial aspects of the legislation is its deep cuts to Medicaid:</p>

<ul>

<li>$698 billion reduction over a decade</li>

<li>New work requirements: Able-bodied adults aged 19–55 must work at least 80 hours per month to qualify for coverage</li>

<li>Stricter eligibility checks, set to begin December 31, 2026</li>

</ul>

<p>The Congressional Budget Office estimates that up to 11.8 million Americans could lose Medicaid coverage over the next ten years.<br />To soften the blow, the bill includes $10 billion annually for rural hospitals over five years — a $50 billion fund aimed at keeping critical care available in underserved regions.</p>

<h2>A Hard Line on Immigration and National Security</h2>

<p>Delivering on Trump’s tough immigration promises, the bill dedicates $350 billion to enforcement and national defense, marking the most significant crackdown in decades:</p>

<ul>

<li>100,000 immigration detention beds</li>

<li>10,000 new ICE agents, each with a $10,000 signing bonus</li>

<li>Expanded Border Patrol staffing</li>

<li>New fees for asylum seekers and green card applicants</li>

</ul>

<p><br />It also steers $25 billion toward the “Golden Dome” missile defense system and channels another $1 billion to border-related operations managed by the Department of Defense.</p>

<h2>A Blow to Clean Energy Initiatives</h2>

<p>Another major shift comes in the rollback of clean energy tax incentives, many of which were introduced in the 2022 Inflation Reduction Act. The new law will:</p>

<ul>

<li>Eliminate tax credits for electric vehicle purchases, solar panels, home energy efficiency upgrades, and charging stations — effective 60 days after enactment</li>

<li>Dismantle the Greenhouse Gas Reduction Fund, a program that supported local environmental initiatives</li>

</ul>

<p>Only nuclear energy projects currently under construction (through 2028) will remain eligible for federal support.</p>

<h2>State and Local Tax (SALT) Deduction Gets a Temporary Boost</h2>

<p>For taxpayers in high-tax states, the bill offers a temporary reprieve on SALT deductions:</p>

<ul>

<li>The deduction cap increases from $10,000 to $40,000 for households earning up to $500,000</li>

<li>However, this change expires in 2030, after which the cap reverts to its previous level</li>

</ul>

<h2>A Tectonic Policy Shift — But At What Cost?</h2>

<p>This sweeping legislation reflects a bold and controversial vision for America’s future — one that prioritizes tax relief, immigration enforcement, and military strength, while rolling back environmental and public health spending. With such sweeping changes, the bill is expected to become a defining piece of Trump’s political legacy.<br />But the question remains: Will these sweeping changes uplift the middle class and secure America’s borders, or will they widen inequality and weaken the social safety net?</p>

World

Trump’s ‘Big Beautiful Bill’ Passed: Everything You Need To Know About The Tax And Spending Law

by aweeincm

Recent Post

Israeli Strikes Intensify In Gaza City As Netanyahu’s Cabinet Weighs Plan To Seize Territory

<p>Israeli forces unleashed heavy air and ground assaults on the ... Read more

Assamese Journalist Shot At During Cultural Event in Manipur

An Assamese journalist working for a Nagaland-based television channel was ... Read more

World’s Richest People In 2025 And Their Educational Qualifications

Richest People In World List: The second richest person and ... Read more

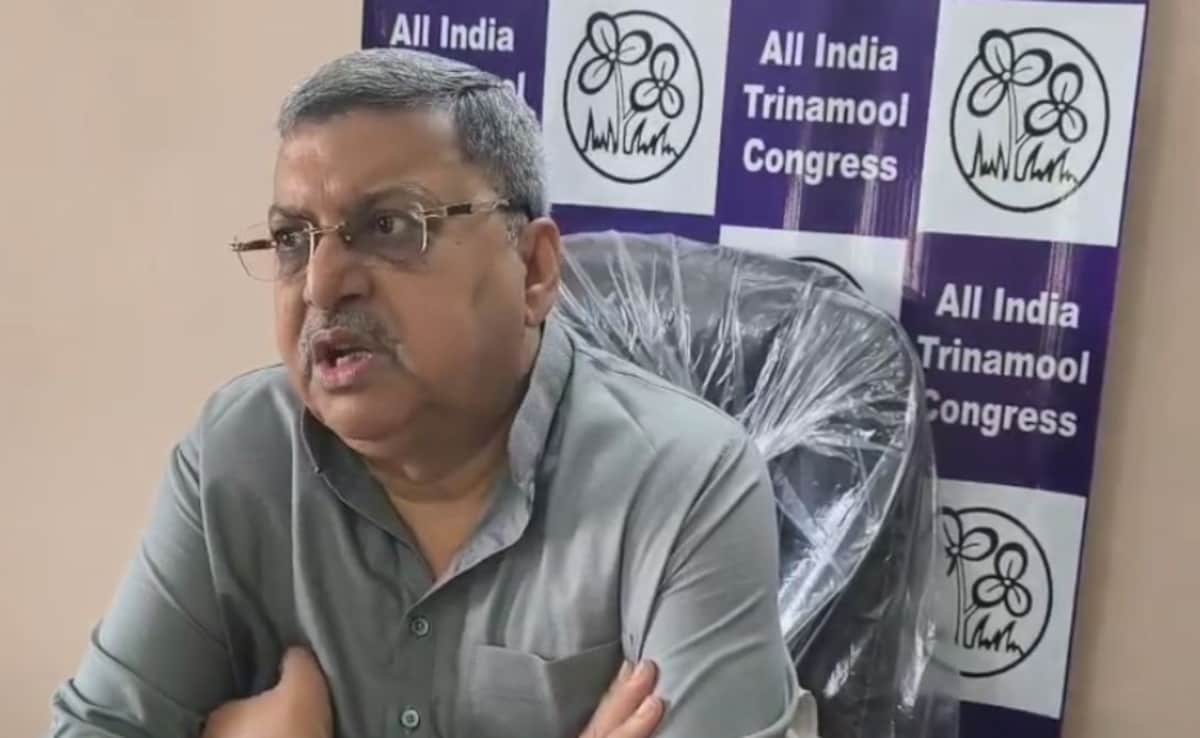

Trinamool Leader Claims BJP MP Threatened Him, Then Blames Party Colleagues

Kalyan Banerjee, who had resigned as the party’s chief whip ... Read more