<p>In a significant move toward reshaping global tax policy, the United States and fellow Group of Seven (G7) nations have agreed to support a proposal that would shield American companies from certain elements of a broader international tax agreement. The G7, currently under Canada’s presidency, confirmed the development in a joint statement released on Saturday.</p>

<p>At the heart of the agreement is the creation of a “side-by-side” system—an alternative framework designed to address concerns raised by the United States. This move comes after the U.S. administration committed to removing the controversial Section 899 retaliatory tax, a legacy clause from former President Donald Trump’s tax and spending bill.</p>

<p>According to the G7, the new arrangement acknowledges the U.S.’s existing minimum tax laws and seeks to foster greater stability in the international tax landscape. The goal, leaders said, is to align with the Inclusive Framework—a global initiative tackling tax base erosion and profit shifting—while preserving the progress already achieved.</p>

<p>Following the removal of Section 899 from the U.S. Senate version of the bill, the Treasury Department issued a statement on social media platform X, saying:</p>

<p>“There is now a shared understanding that a side-by-side system could maintain the gains made by countries within the Inclusive Framework.”</p>

<p>The impact of this agreement stretches beyond American borders. UK-based businesses, which had expressed growing anxiety over potential tax hikes linked to Section 899, are now breathing a sigh of relief. The removal of the provision offers much-needed clarity and financial assurance.</p>

<p>“Today’s agreement provides much-needed certainty and stability for those businesses after they had raised their concerns,” said UK Finance Minister Rachel Reeves. She also emphasized that efforts must continue to curb aggressive tax avoidance strategies.</p>

<p>G7 officials echoed this sentiment, stating they are eager to engage in further discussions to develop a system that is both effective and acceptable to all parties involved.</p>

<p>The backdrop to this unfolding tax debate traces back to January, when Donald Trump—via executive order—declared the 2021 global corporate minimum tax deal non-applicable in the United States. The agreement, originally negotiated under the Biden administration and endorsed by nearly 140 countries, was aimed at creating a fairer international tax system by ensuring multinational corporations paid a baseline rate regardless of where they operated.</p>

<p>Trump not only rejected the deal but also pledged to retaliate against countries that taxed U.S. firms under its provisions. Section 899, in particular, was seen as a retaliatory measure with far-reaching consequences for foreign companies doing business in America.</p>

World

G7 Backs US Push To Ease Global Tax Rules, Offers Relief To American And British Businesses

by aweeincm

Recent Post

Tamil Nadu Dalit Techie Murder: Case Transferred To Crime Branch Amid Outrage

The Tamil Nadu police have transferred the case involving the ... Read more

UP Man Stabs Wife To Death In Front Of 7-Year-Old Daughter In Tehsil Office

A 39-year-old truck driver fatally stabbed his wife in front ... Read more

“Congress Gave Away PoK, BJP WIll Get It Back”: Amit Shah In Rajya Sabha

Union Home Minister Amit Shah issued a strong response to ... Read more

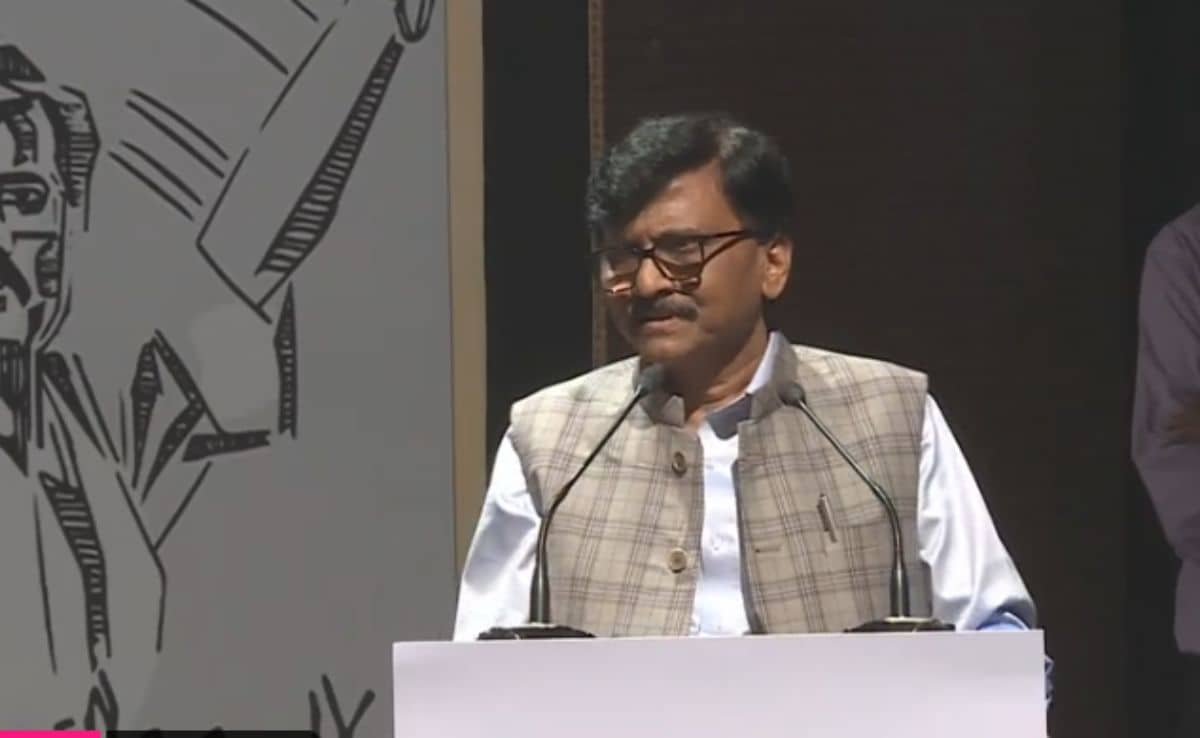

“Fadnavis Act”: Sanjay Raut’s Big Allegation As Agency Probes Civic Official

The Enforcement Directorate’s ongoing probe into former Vasai-Virar Municipal Commissioner ... Read more