<p>Islamabad, Jun 10 (PTI) Tax exemptions to various sectors cost Pakistan more than USD 21 billion this year, a higher amount than the USD 17 billion the country is required to repay against its maturing commercial and bilateral external debt, according to the latest economic survey.</p>

<p>Unveiled by Finance Minister Muhammad Aurangzeb on Monday, the Economic Survey of Pakistan 2024-25 documents various economic developments and indicators in a fiscal year.</p>

<p>According to the document, the cost of tax exemptions surged to a record Rs 5.8 trillion in the current fiscal year (2024-25), a rise of nearly Rs 2 trillion in the first year of the present government from the previous fiscal year’s Rs 3.9 trillion.</p>

<p>The Express Tribune newspaper reported that in dollar terms, the cost of tax losses was USD 21 billion, substantially higher than the USD 17 billion Pakistan is required to repay this year against its maturing commercial and bilateral external debt owed to China, Saudi Arabia, the United Arab Emirates, and Kuwait.</p>

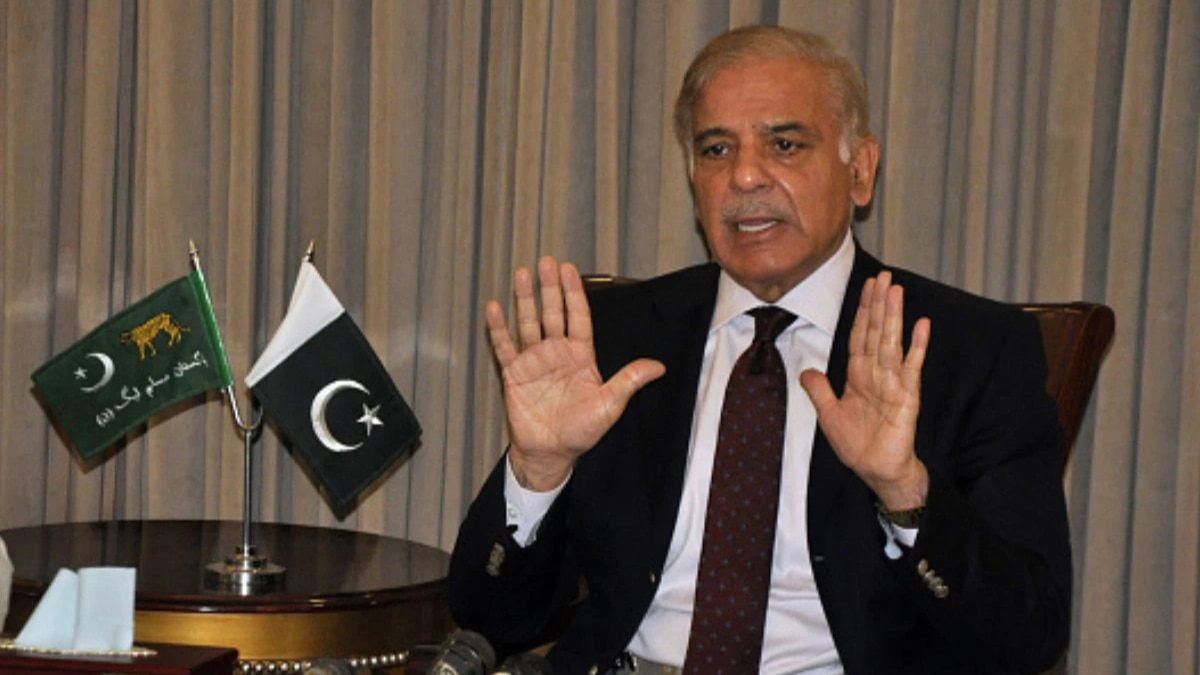

<p>The survey showed that the jump in tax expenditure figure this year reflects a Rs 1.96 trillion or 51 per cent increase, despite the Pakistan Muslim League-Nawaz (PML-N) government removing several exemptions in its last budget.</p>

<p>Despite multiple rounds of withdrawing tax concessions and exemptions, the amount has continued to rise annually, according to the economic survey. These exemptions, approved over the years, are protected under three distinct tax laws.</p>

<p>The survey reported sales tax exemptions worth Rs 4.3 trillion in the outgoing fiscal year, compared to Rs 2.9 trillion in the previous year, a nearly 50 per cent rise.</p>

<p>Income tax exemptions totalled Rs 801 billion in the outgoing fiscal year, up 68 per cent from Rs 477 billion last year, according to the Federal Board of Revenue’s estimates.</p>

<p>This increase came despite the government’s decision to shift more tax burdens onto salaried individuals while sparing other sectors like retailers.</p>

<p>Customs duty exemptions increased to Rs 786 billion this fiscal year, up Rs 243 billion or 45 per cent from Rs 543 billion last year, the survey showed.</p>

<p>The reported Rs 5.8 trillion in “tax expenditures for 2025” casts doubt on the credibility of previously published losses, according to the report.</p>

<p>Despite efforts by successive governments to scale back and eliminate tax expenditures, it continues to grow steadily. According to the newspaper, this indicates either the introduction of numerous hidden tax exemptions during the fiscal year or the understatement of the prior year’s figures.</p>

<p>There has been no extraordinary increase in economic activity to justify such a sharp spike in tax exemption costs, according to the report. </p>

<p><em><strong>(This report has been published as part of the auto-generated syndicate wire feed. Apart from the headline, no editing has been done in the copy by ABP Live.)</strong></em></p>

World

Pakistan Loses $21 Billion To Tax Exemptions Alone This Year On Top Of $17 Billion External Debt: Survey

by aweeincm

Recent Post

Boeing 787-8, Which Crashed In Ahmedabad, Had Immaculate Safety Record

The Air India Ahmedabad-London flight crashed this afternoon, marking the ... Read more

Air India Ahmedabad-London Plane Crash: What We Know So Far

An Air India Boeing 787-8 Dreamliner operating as Flight AI171 ... Read more

“Last Night In India”: Briton’s Instagram Post Before Boarding Doomed Air India Flight

London-based yoga enthusiast Jamie Meek had concluded his Gujarat visit ... Read more

Indian Students At Harvard Navigate Uncertainties

Indian students at Harvard say they are navigating a “rollercoaster” ... Read more